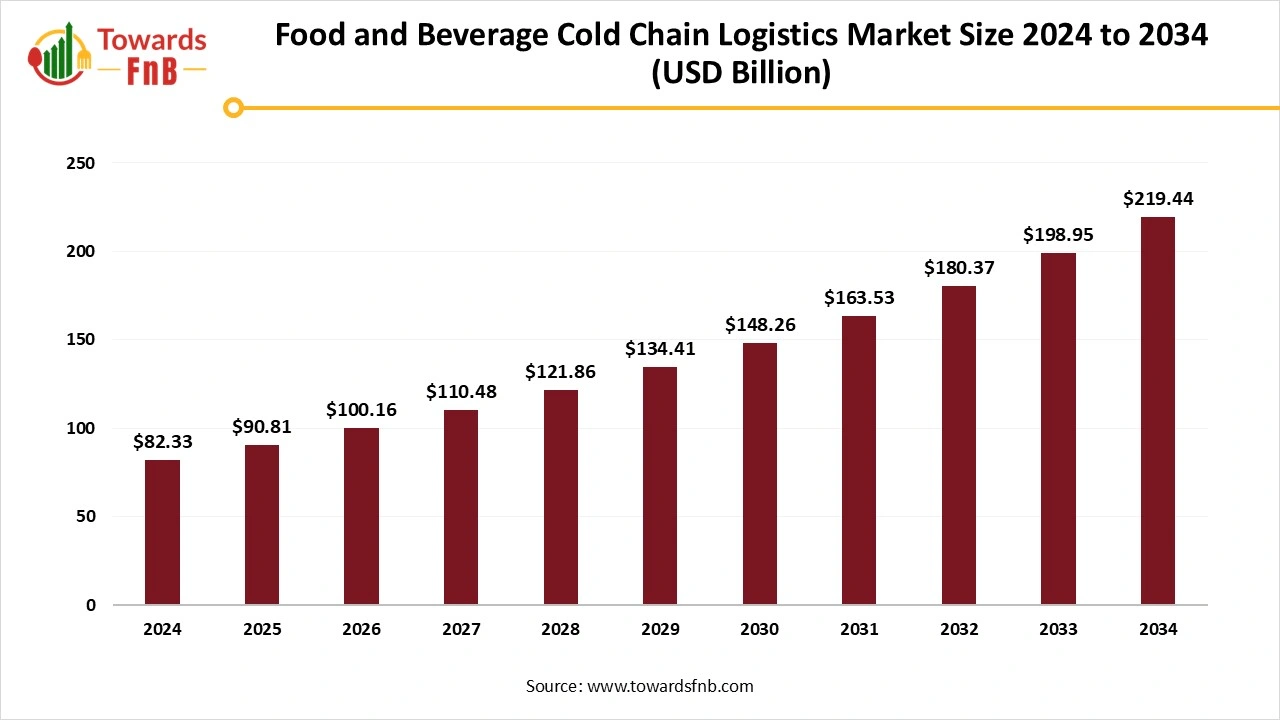

Food and Beverage Cold Chain Logistics Market Size Forecast to Reach USD 219.44 Billion by 2034, Driven by Health and Sustainability Demands

According to Towards FnB, the global food and beverage cold chain logistics market size is calculated at USD 90.81 billion in 2025 and is forecasted to hit around USD 219.44 billion by 2034, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034.

Ottawa, Aug. 14, 2025 (GLOBE NEWSWIRE) -- The global food and beverage cold chain logistics market size accounted for USD 82.33 billion in 2024 and is predicted to rise form USD 90.81 billion in 2025 to around USD 219.44 billion by 2034, expanding at a CAGR of 10.3% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research. The food and beverage cold chain logistics market is rapidly expanding, fueled by the growing demand for fresh and frozen foods.

The market is one of the booming markets in recent periods due to high demand for frozen food, the growth of e-commerce platforms, and the rising demand for storing food due to the growth of food-serving outlets.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5606

Market Overview

The food and beverage cold chain logistics market has observed a significant growth in recent years due to the growth of the food and beverage industry globally, comprising consumers from various age groups. Increasing consumption of fresh and frozen food, operational efficiency, increasing food delivery services, along advanced technologies, are also some of the major factors in the growth of the market for food and beverage cold chain logistics. Changing eating habits of the growing population, especially the Gen Z generation, is also leading to the growth of the market. Innovative packaging, reduced food wastage, and improved food quality are also some of the major factors aiding the market’s growth.

The industry is undergoing a structural transformation driven by real-time monitoring systems, predictive maintenance, and sustainability-focused refrigeration solutions, said Vidyesh Swar, Principal Consultant at Towards FnB. “These developments are improving operational efficiency while reducing wastage and ensuring compliance with stringent food safety standards.

Key Highlights of the Food and Beverage Cold Chain Logistics Market

- By region, North America dominated the food and beverage cold chain logistics market due to the presence of advanced technologies and increasing preference for frozen foods and snack options.

- By region, the Asia Pacific is expected to grow in the foreseen period with the help of improving technological standards, high demand for fresh and frozen snack options, and the growth of the food and beverage industry.

- By application, the fruits, vegetables, and beverages segment led the market in 2024, whereas the meat and seafood segment is expected to grow in the foreseeable period.

- By type, the warehouse segment led the food and beverage cold chain logistics market in 2024, whereas the transportation segment is expected to grow in the foreseeable period.

- By end-use, the retail segment led the food and beverage cold chain logistics market in 2024, whereas the e-commerce segment is expected to grow in the expected timeframe.

New Trends of Food and Beverage Cold Chain Logistics Market

- Refrigeration technology with lower environmental impact, improved cooling to keep the food items safe, and lower energy costs is helping the growth of the food and beverage cold chain logistics market.

- Improved refrigeration technology, helpful to maintain a stable temperature to enhance the shelf life of food products, is also helping the growth of the market.

- Increased automation in refrigeration technology in the form of an IoT-enabled cold chain logistics system, for real-time management and real-time monitoring, is also helping the growth of the market.

Sustainability Initiatives

The industry is moving toward low-GWP refrigerants, solar-powered warehouses, and energy-efficient reefer units to meet net-zero targets. These measures aim to reduce greenhouse gas emissions, control operational expenses, and comply with evolving environmental regulations.

How Has AI Transformed the Food and Beverage Cold Chain Logistics Market?

Artificial intelligence (AI) has significantly transformed the food and beverage cold chain logistics market by enhancing efficiency, accuracy, and product safety. AI-powered systems enable real-time monitoring of temperature, humidity, and other critical conditions throughout storage and transportation, ensuring compliance with food safety standards and reducing spoilage. Machine learning algorithms analyze large volumes of logistics and environmental data to predict potential equipment failures, route disruptions, or temperature deviations, allowing for proactive interventions. AI also supports demand forecasting, optimizing inventory levels to minimize waste and reduce operational costs. In addition, computer vision and automated quality inspection tools help detect damaged or compromised products before they reach consumers. By integrating with IoT devices and cloud platforms, AI ensures end-to-end visibility, transparency, and traceability across the cold chain, strengthening both operational reliability and consumer trust.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-and-beverage-cold-chain-logistics-market

Recent Developments in the Food and Beverage Cold Chain Logistics Market

- In May 2025, Just Deliveries, a Cold-Chain logistics startup focused on mid-mile transport for the food and beverage industry, raised INR 5.5 crores in a funding round led by VC Grid and NABVentures. (Source- https://www.entrepreneur.com)

- In May 2025, Noatum Logistics, part of AD Ports Group, opened its first robotically assisted, refrigerated warehouse in Lisbon to support the company’s advancing business in the Western Mediterranean. (Source- https://www.porttechnology.org)

Case Study: ColdStar Logistics' New Distribution Hub and Technological Integration

Overview

ColdStar Logistics, a leading provider of temperature-controlled supply chain solutions, recently expanded its operations with a new distribution hub in Visakhapatnam, Andhra Pradesh. This hub is strategically designed to address the rising demand for real-time deliveries in temperature-sensitive sectors, including the food and beverage industry. The expansion aims to support the increasing need for efficient and safe cold chain logistics, ensuring timely delivery of goods across India.

Key Features:

- Advanced Infrastructure: The new facility can store over 3,500 pallets and is optimized for seamless logistics operations, such as sourcing, cross-docking, reverse logistics, and last-mile fulfillment.

- Strategic Location: Positioned near Vizag, India's largest seaport, the new hub benefits from easy access to both domestic and international supply chains, further enhancing operational efficiency.

- End-to-End Visibility: ColdStar's real-time monitoring and control systems provide full visibility across the supply chain, ensuring that temperature-sensitive goods maintain product integrity from origin to destination.

Impact:

- This expansion is critical for addressing the growing demand for fresh and frozen foods, which require highly reliable cold chain solutions. By improving its infrastructure, ColdStar is better positioned to meet the increasing demand for temperature-sensitive goods while maintaining high standards of food safety and freshness.

- The integration of advanced tracking and monitoring technology ensures that the cold chain remains intact, reducing the risk of spoilage and waste—critical concerns in the food and beverage cold chain logistics market.

- ColdStar’s use of automation and real-time monitoring systems aligns directly with the trends you highlighted in your press release, such as the adoption of IoT-enabled cold chain systems and the shift toward more energy-efficient, environmentally friendly solutions.

Market Dynamics

What are the Growth Drivers of the Food and Beverage Cold Chain Logistics Market?

Multiple growth drivers are fueling the growth of the food and beverage cold chain logistics market in recent periods. High demand for fresh and frozen snacks, the growing food and beverage industry, technologically advanced refrigeration technology, and various similar factors are helping the growth of the food and beverage cold chain logistics market. Increased international trade of frozen items with the help of technologically advanced refrigeration techniques is also helping the growth of the market. Growth of online platforms requiring temperature-controlled sales is also fueling the market’s growth.

Restraint

How Are Increased Operational Costs Hampering the Growth of the Food and Beverage Cold Chain Logistics Market?

Construction of temperature-controlled warehouses and cold storage facilities for the storage and export of fresh and frozen food items is one of the major costs incurred by the industry, leading to high operational costs. Such costs may restrain the growth of the food and beverage cold chain logistics market. International regulations and laws for such trading may also act as an obstacle to the growth of the market. Hence, such issues lower the profitability factors and act as restraints sometimes.

Opportunity

How Is Emerging Technology Expected to Shape the Growth of the Food and Beverage Cold Chain Logistics Market in the Future?

Innovative technologies for real-time monitoring and tracking of the package help manufacturers to keep track of their products and their shelf life, which is helping the growth of the market for food and beverage cold chain logistics. Smart packaging with embedded sensors to track the package along with the information of the content inside is also helping in ideal management and growth of the market as well. Such innovations are helping the market to grow in the foreseeable period.

Adoption of AI-based route optimization in cold chain transport is projected to increase by 35% by 2028, enabling fuel consumption reductions of up to 15%. Renewable-powered cold storage facilities are expected to represent 12% of new warehouse capacity by 2030.

Food and Beverage Cold Chain Logistics Market Regional Analysis

North America dominated the Food and Beverage Cold Chain Logistics Market in 2024.

North America dominated the food and beverage cold chain logistics market in 2024 due to multiple factors, helping the growth of the market in the region. Factors such as growing demand for frozen and fresh food items, growth of online food delivery platforms, and improving refrigerating and cold storage technologies are some of the major factors for the growth of the food and beverage cold chain logistics market in the region. The U.S and Canada are the major contributing countries in the growth of the market in North America.

Asia Pacific is observed to be the fastest-growing region in the Forecast Period.

Asia Pacific is observed to be the fastest-growing region in the foreseen period, aiding the growth of the food and beverage cold chain logistics market. Factors such as increasing disposable income, improving standard of living, and urbanization are leading to the growth of the market. Improved technology for real-time monitoring, real-time data, and sensors for tracking the package are another set of factors helpful for the market’s growth. Countries like India, China, Japan, and South Korea have a major contribution to the growth of the market in the region.

Food and Beverage Cold Chain Logistics Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 10.3% |

| Market Size in 2024 | USD 82.33 Billion |

| Market Size in 2025 | USD 90.81 Billion |

| Market Size by 2034 | USD 219.44 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food and Beverage Cold Chain Logistics Market Segmental Analysis

Application Analysis

The fruits, vegetables, and beverages segment led the food and beverage cold chain logistics market in 2024, as they are the staple food products required in our daily lives. Improved storage facilities aid the shelf life of such products, helping the growth of the market. Technological advancements for real-time tracking and monitoring help to lower the food wastage and maintain the condition of such food products as well. Hence, the segment led the market in 2024.

The meat and seafood segment is set to grow at an exponential rate, driven by rising global consumption patterns and the increasing need for maintaining product freshness and safety across the supply chain. Meat and seafood products are highly perishable due to their high-fat and protein content, as well as their high water activity, which creates an environment conducive to bacterial growth if not stored properly. These characteristics make stringent cold chain management essential to prevent spoilage, preserve nutritional quality, and extend shelf life.

Type Analysis

The warehouse segment led the food and beverage cold chain logistics market in 2024. Increasing demand for frozen food products, dairy products, pharmaceutical products, and other similar items requiring proper refrigeration and temperature-controlled warehouses helps the growth of the market. Such items need proper temperature control to maintain their shelf life, further fueling the growth of the market.

The transportation segment is expected to grow in the food and beverage cold chain logistics market during the forecast period. Refrigerated containers are used for shipping items for long distances with short shelf life, which is helping the growth of the market for food and beverage cold chain logistics in the foreseeable period. Advanced technology, helpful for companies to track and manage their products along with real-time monitoring and smart packaging, is also helping the growth of the market. Hence, the segment is helpful to maintain the shelf life of easily perishable products such as probiotics, dairy, and pharmaceutical products.

End-Use Analysis

The retail segment dominated the food and beverage cold chain logistics market in 2024. High demand for supermarkets, hypermarkets, and convenience stores is helping the growth of the food and beverage cold chain logistics market. The cold chain logistics are highly important for multiple domains, especially for the food and beverage industry; hence, such factors also help the growth of the market. Cold chain logistics help in the growth of the food and beverage industry by maintaining the shelf life of fruits, vegetables, seafood, and other food items. Hence, the segment led the market in 2024.

Meanwhile, the e-commerce segment is expected to grow in the forecast period at the fastest rate because of the high demand for frozen food items on online platforms is leading to the growth of the food and beverage cold chain logistics market in the foreseeable future. Online food and grocery delivery platforms have been in high demand in recent periods due to their convenience, discounts in price, and other beneficial factors. Hence, the segment is observed to grow in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- AI in Food and Beverages Market: The global AI in food and beverages market size is expected to grow from USD 16.36 billion in 2025 to USD 320.94 billion by 2034, at a CAGR of 39.2% over the forecast period from 2025 to 2034.

- Private Label Food and Beverages Market: The global private label food and beverages market size is projected to witness strong growth from USD 255.90 billion in 2025 to USD 393.60 billion by 2034, reflecting a CAGR of 4.9% over the forecast period from 2025 to 2034.

- Specialty Food Ingredients Market: The global specialty food ingredients market size is projected to witness strong growth from USD 113.01 billion in 2025 to USD 179.87 billion by 2034, reflecting a CAGR of 5.3% over the forecast period from 2025 to 2034.

- Food for Special Medical Purpose Market: The global food for special medical purpose market size is positioned for rapid expansion, with projected revenue increases over the next decade, spurred by the widespread efforts by key players across the globe.

- Natural Food Colorants Market: The global natural food colorants market size is projected to grow from USD 2.06 billion in 2025 to USD 3.96 billion by 2034, reflecting a CAGR of 7.5% over the forecast period from 2025 to 2034.

- Hemp-Based Foods Market: The global hemp-based foods market size is projected to climb USD 7.83 billion by 2025 to USD 19.24 billion by 2034, expanding at a CAGR of 10.5% during the forecast period from 2025 to 2034.

- Organic Pet Food Market: The global organic pet food market size is projected to expand from USD 2.54 billion in 2025 to USD 4.41 billion by 2034, growing at a CAGR of 6.34% during the forecast period from 2025 to 2034.

- Canada Food Service Market: The Canada food service market size is course to grow from USD 135.63 billion in 2025 to USD 583.47 billion by 2034, growing at a CAGR of 17.6% during the forecast period from 2025 to 2034.

- Wet Pet Food Market: The global wet pet food market size is projected to witness strong growth from USD 27.90 billion in 2025 to USD 41.75 billion by 2034, reflecting a CAGR of 4.58% over the forecast period from 2025 to 2034.

- Food Service Market: The global food service market size is projected to witness strong growth from USD 3,758.58 billion in 2025 to USD 7,389.11 billion by 2034, reflecting a CAGR of 7.8% over the forecast period from 2025 to 2034.

-

Enriched Food Market: The global enriched food market size is expected to grow from USD 196.33 billion in 2025 to USD 460.30 billion by 2034, at a CAGR of 9.93% over the forecast period from 2025 to 2034.

Food and Beverage Cold Chain Logistics Market Key Players

- Americold Realty Trust Inc.

- Burris Logistics Co.

- Capstone Logistics LLC

- Claus Sorensen AS

- Coldco Logistics

- ColdEX Ltd.

- Frigoscandia AB

- Hanson Logistics Ltd.

- John Swire and Sons Ltd.

- Kalypso

- Kloosterboer

- Lineage Logistics Holdings LLC

- NewCold Cooperatief UA

- Nichirei Corp.

- Seafrigo Group

- Stockhabo

- Tippmann Group

- TRENTON COLD STORAGE

- VersaCold Logistics Services

Segments Covered in the Report

- By Application

- Meat and seafood

- Dairy and frozen desserts

- Fruits vegetables and beverages

- Bakery and confectionary

By Type

- Warehouse

- Transportation

By End-user

- Retail

- Food service

- E-commerce

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5606

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies |

For Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.